August was yet another solid month for home sales in the neibhborhood of Old Torrance. 9 homes sold during the month with the lowest price of the month being a 1 bedroom condo selling at $339,000 and the highest of the month was a duplex on El Prado selling at $1,060,000. See also the current homes for sale in Old Torrance.

August 2019 Home Sales in Old Torrance

|

MLS

|

Type

|

Address |

Sales Price

|

$ Per Foot

|

Bed/Bath

|

Sq Feet

|

Year

|

Close Date

|

|

|

SB19138138

|

CONDO/A

|

1281 | Cabrillo A |

$339,000

|

$559.41

|

1/1,0,0,0

|

606/A

|

1993/ASR

|

8/13/2019

|

|

CV19065414

|

SFR/D

|

707 | Pacific LN |

$502,500

|

$761.36

|

2/1,0,0,0

|

660/A

|

1918/ASR

|

8/9/2019

|

|

SB19139707

|

CONDO/A

|

2700 | Arlington |

$660,000

|

$386.19

|

3/2,0,1,0

|

1709/A

|

1982/ASR

|

8/20/2019

|

|

SB19149311

|

SFR/D

|

1751 | Gramercy |

$680,000

|

$721.87

|

2/1,0,0,0

|

942/A

|

1912/ASR

|

8/28/2019

|

|

PV19114609

|

TWNHS/A

|

1800 | Oak ST # |

$698,000

|

$524.81

|

2/2,0,1,0

|

1330/A

|

2007/ASR

|

8/19/2019

|

|

SB19124671

|

CONDO/A

|

2349 | Jefferson |

$729,500

|

$578.97

|

2/2,0,0,0

|

1260/A

|

2008/ASR

|

8/28/2019

|

|

PV19152725

|

TWNHS/A

|

1800 | Oak ST # |

$845,000

|

$431.12

|

3/3,0,0,0

|

1960/A

|

2007/ASR

|

8/5/2019

|

|

SB19063943

|

SFR/D

|

1448 | Engracia A |

$950,000

|

$417.40

|

4/2,0,0,0

|

2276/A

|

1930/ASR

|

8/2/2019

|

|

SB19064463

|

DPLX/D

|

1447 | El Prado A |

$1,060,000

|

$424.17

|

5/4,0,0,0

|

2499/A

|

1938/ASR

|

8/16/2019

|

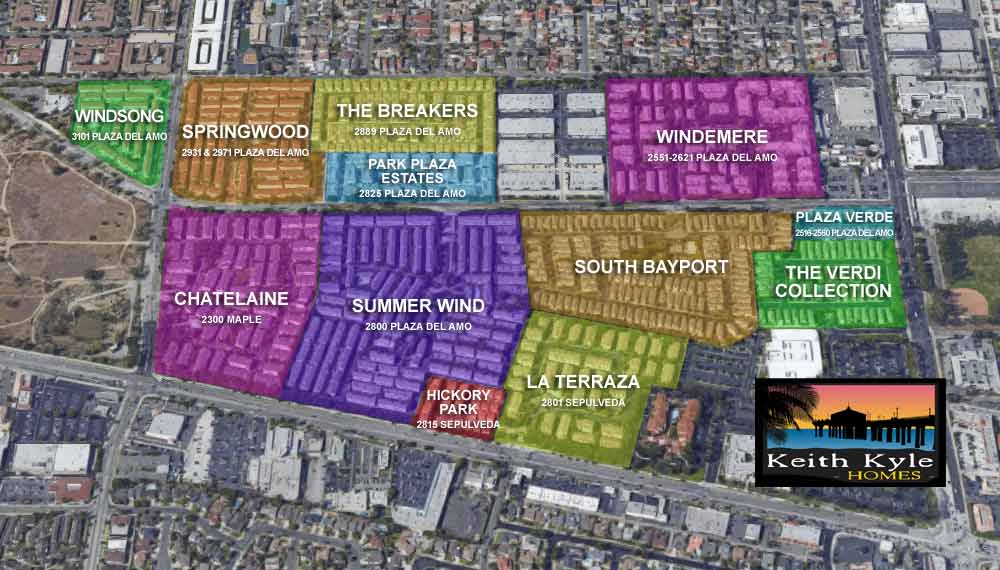

wonderful communities offer an ideal housing solution for many home buyers. Plaza Del Amo is a street (actually two distinct streets) that range from Madrona to Crenshaw and then pick up a few blocks away from Torrance Blvd to Border Ave. The bulk of the complexes that make up Plaza Del Amo are centered around the Madrona to Crenshaw section but not all street addresses are actually Plaza . The housing options vary from condominium units, to townhouses, to detached three and four bedroom single family style homes. Although some of the complexes have street addresses not on Plaza Del Amo the community in general is known by this name. Click on the map below to see information specific to that community or complex.

wonderful communities offer an ideal housing solution for many home buyers. Plaza Del Amo is a street (actually two distinct streets) that range from Madrona to Crenshaw and then pick up a few blocks away from Torrance Blvd to Border Ave. The bulk of the complexes that make up Plaza Del Amo are centered around the Madrona to Crenshaw section but not all street addresses are actually Plaza . The housing options vary from condominium units, to townhouses, to detached three and four bedroom single family style homes. Although some of the complexes have street addresses not on Plaza Del Amo the community in general is known by this name. Click on the map below to see information specific to that community or complex.